ORIGINAL Dec 1929 WALL STREET JOURNAL newspaper just afterTHE STOCK MARKET CRASH For Sale

When you click on links to various merchants on this site and make a purchase, this can result in this site earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network.

ORIGINAL Dec 1929 WALL STREET JOURNAL newspaper just afterTHE STOCK MARKET CRASH:

$40.00

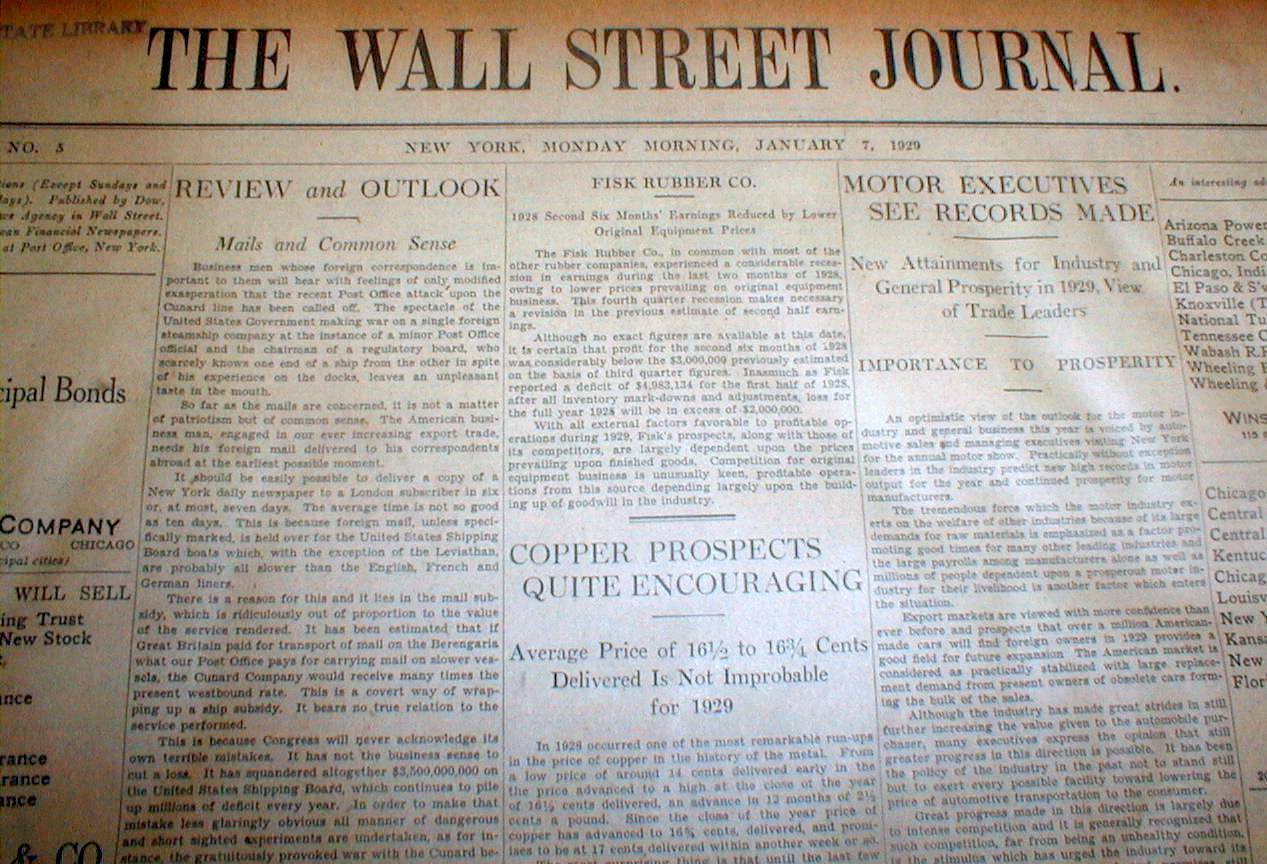

An ORIGINAL December, 1929 WALL STREET JOURNAL newspaper shortly after the Oct, 1929 STOCK MARKET CRASH - inv # 2Z-334SEE PHOTO----- AnORIGINALNEWSPAPER,the Wall Street Journal (NY) dated in December, 1929, the year of the GREATSTOCK MARKET CRASH and the beginning of the GREAT DEPRESSION.

The exact date of this original Dec, 1929 Wall Street Journal is selected at randomfrom our limited inventory of this newspaper dated in December, 1929. Read allthe news and stock quotes as they were in flux just after the GREAT CRASH of Oct 24-29, 1929 that set in motion the GREAT DEPRESSION.

Great UNIQUE item for a present-day stock broker or investor to frame and display in their office! It sure makes a great conversation piece for new and existing clients who see it.

The Wall Street Crash of 1929, also known as Black Tuesday or the Stock Market Crash of 1929, began in late October 1929 and was the most devastating stock market crash in the history of the United States, when taking into consideration the full extent and duration of its fallout. The crash signaled the beginning of the 10-year Great Depression that affected all Western industrialized countries.

The Roaring Twenties, the decade that followed World War I and led to the Crash, was a time of wealth and excess. Building on post-war optimism, many rural Americans migrated to the cities in vast numbers throughout the decade with the hopes of finding a more prosperous life in the ever growing expansion of America's industrial sector. While the American cities prospered, the vast migration from rural areas and continued neglect of the US agriculture industry would create widespread financial despair among American farmers throughout the decade and would later be blamed as one of the key factors that led to the 1929 stock market crash.

Despite the dangers of speculation, many believed that the stock market would continue to rise indefinitely. On March 25, 1929, however, a mini crash occurred after investors started to sell stocks at a rapid pace, exposing the market's shaky foundation. Two days later, banker Charles E. Mitchell announced his company the National City Bank would provide $25 million in credit to stop the market’s slide. Mitchell's move brought a temporary halt to the financial crisis and call money declined from 20 to eight percent. However, the American economy was now showing ominous signs of trouble. Steel production was declining, construction was sluggish, car sales were down, and consumers were building up high debts because of easy credit.

The market had been on a nine-year run that saw the Dow Jones Industrial Average increase in value tenfold, peaking at 381.17 on September 3, 1929. Shortly before the crash, economist Irving Fisher famously proclaimed, "Stock prices have reached what looks like a permanently high plateau." The optimism and financial gains of the great bull market were shaken on September 18, 1929, when share prices on the New York Stock Exchange (NYSE) abruptly fell.

On September 20, the London Stock Exchange (LSE) officially crashed when top British investor Clarence Hatry and many of his associates were jailed for fraud and forgery. The LSE's crash greatly weakened the optimism of American investment in markets overseas. In the days leading up to the crash, the market was severely unstable. Periods of selling and high volumes of trading were interspersed with brief periods of rising prices and recovery. Economist and author Jude Wanniski later correlated these swings with the prospects for passage of the Smoot–Hawley Tariff Act, which was then being debated in Congress.

On October 24 ("Black Thursday"), the market lost 11% of its value at the opening bell on very heavy trading. Several leading Wall Street bankers met to find a solution to the panic and chaos on the trading floor. The meeting included Thomas W. Lamont, acting head of Morgan Bank; Albert Wiggin, head of the Chase National Bank; and Charles E. Mitchell, president of the National City Bank of New York. They chose Richard Whitney, vice president of the Exchange, to act on their behalf.

With the bankers' financial resources behind him, Whitney placed a offer to purchase a large block of shares in U.S. Steel at a price well above the current market. As traders watched, Whitney then placed similar offers on other "blue chip" stocks. This tactic was similar to one that ended the Panic of 1907. It succeeded in halting the slide. The Dow Jones Industrial Average recovered, closing with it down only 6.38 points for the day; however, unlike 1907, the respite was only temporary.

Over the weekend, the events were covered by the newspapers across the United States. On October 28, "Black Monday", more investors decided to get out of the market, and the slide continued with a record loss in the Dow for the day of 38.33 points, or 13%.The next day, "Black Tuesday", October 29, 1929, about sixteen million shares were traded, and the Dow lost an additional 30 points, or 12%, amid rumors that U.S. President Herbert Hoover would not veto the pending Smoot–Hawley Tariff Act. The volume of stocks traded on October 29, 1929 was a record that was not broken for nearly 40 years.

On October 29, William C. Durant joined with members of the Rockefeller family and other financial giants to buy large quantities of stocks in order to demonstrate to the public their confidence in the market, but their efforts failed to stop the large decline in prices. Due to the massive volume of stocks traded that day, the ticker did not stop running until about 7:45 p.m. that evening. The market had lost over $30 billion in the space of two days which included $14 billion on October 29 alone.

Fair condition. Some paper chipping at edges. Some may have small areas of missing paper at edges. This listing includes the original newspaper, NOT just a clipping or a page of it. STEPHEN A. GOLDMAN HISTORICAL NEWSPAPERS stands behind all of the items that we sell with a no questions asked, money back guarantee. Every item we sell is an original newspaper printed on the date indicated at the beginning of its description. U.S. buyers pay priority mail postage which includes waterproof plastic and a heavy cardboard flat to protect your purchase from damage in the mail. International postage is quoted when we are informed as to where the package is to be sent. We do combine postage (to reduce postage costs) for multiple purchases sent in the same package. We list thousands of rare newspapers with dates from 1570 through 2004 on each week. This is truly SIX CENTURIES OF HISTORY that YOU CAN OWN!

Stephen A. Goldman Historical Newspapers has been in the business of buying and selling historical newspapers for over 45 years. Dr. Goldman is a consultant to the Freedom Forum Newseum and a member of the American Antiquarian Society. You can buy with confidence from us, knowing that we stand behind all of our historical items with a 100% money back guarantee. Let our 45+ years of experience work for YOU ! We have hundreds of thousands of historical newspapers (and their very early precursors) for sale.

Related Items:

Original Dec 11 1941 Press Release Franklin D Roosevelt FDR WWII Germany War Dec

$899.99

Original DEC/JAN 1969 Corvette News Magazine

$18.00

rare antique original Dec 27th 1862 Delaware United states lottery ticket stub

$49.99